We’ve officially been traveling full-time for the last 6 months. Has it been that long already!?

When we started this journey, we promised to be as transparent as possible about our finances. We haven’t been doing great job of that, mostly because we’re struggling to figure out how we should go about it.

So, rather than over thinking it, we’ve decided to write a quick update on our financial situation. If you want to see EXACTLY what we’re spending and EXACTLY what we’re making, this post is for you!

Travel is expensive!

As we had anticipated, the most difficult part of full-time travel is making it work financially. Traveling the world is expensive! Between currency conversion fees, plane tickets, gas prices, 3 meals a day each and the occasional beer (okay maybe the more-than-occasional beer), our bank account has been dwindling fast!

So, this leads us to the question: Are we broke yet?

Well, before starting this journey, we had saved up ~$10k, but the goal was never to live off of that money. It was meant to be more of a safety net. And I’m happy to say that we still haven’t had to dig into this fund yet!

In March, however, we actually came very close to dipping into our savings. Up until then I had a contract job that was paying enough for us to live, while only having to work a few hours a day. The contract ended but I was still making a little money mentoring UI design students online, around $700 per month.

But, before that payment came in, our bank account had officially hit zero. This was a bit of a reality check for us. It’s pretty scary not knowing how you’re going to afford to live next month!

But luckily I was able to secure a new contract job within about a week. I’ve also taken on some guest blogging gigs and have been able to make around $1000 in the last month with that.

This might not be consistent work, but it’s at least enough to keep us going for the time being.

Getting our spending under control

I can’t emphasize how much of a challenge this has been. When you’re traveling in a new place, there’s nothing like going out for drinks at a local pub or trying out a local restaurant. Trouble is, if you do that enough it starts to rack up quickly. Pretty soon you’re staring at your bank account wondering what the hell happened!

On some days we’ve easily spent $100 just on food and entertainment alone! While it makes for a great time, it’s just not sustainable.

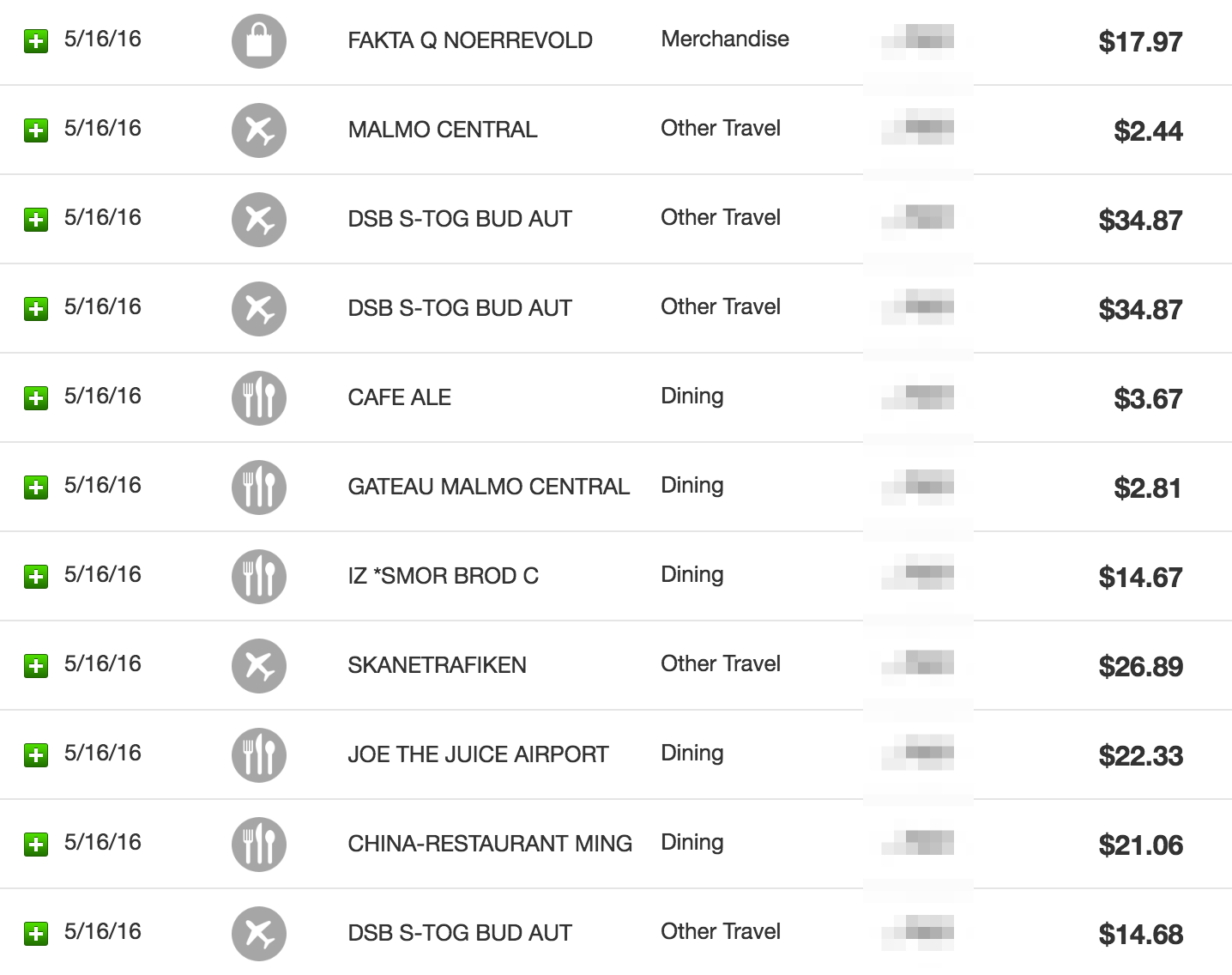

Our credit card statement after just one day of spending!

Our credit card statement after just one day of spending!

So we’re trying our best to be conscious of every dollar we spend. We’ve also been stopping at grocery stores when we first arrive in a new city. This way we can stock up on a few meals and have no more excuses for eating out 3 times a day!

Housing costs

On the 16th of April, we boarded a 15 day, transatlantic cruise. Luckily we booked this well in advance (back in December), so it almost felt like we were staying for free for two weeks! We also had free meals on board and had snuck on our own booze, so we spent hardly anything those two weeks.

But reality set back in when we landed in Barcelona, Spain on May 1st. Honestly, at this point we were glad to never eat the ship buffet again or have to sleep in our tiny cabin! But it also meant that we had to start buying our meals again and paying for housing. What a drag!

We’ve actually been doing pretty well in this department. Here’s the breakdown of our months AirBnB costs since we arrived in Europe.

Dubrovnik, Croatia

4 nights - $134

Copenhagen, Denmark

8 nights - $418

Berlin, Germany

14 nights - $455

This puts us at $1,007 spent in 26 days. Our initial budget was $1000, which we knew was being a bit conservative. But it doesn’t look like we’ll break the budget by too much. I think for the next 30 days we’ll adjust this to maybe $1,250.

Of course, housing costs fluctuate heavily depending on what country you’re visiting. Copenhagen was pretty pricy, but we stayed out of town and roomed with a few friends which brought the cost down. And don’t ask me how we got such a killer price in Berlin. I think we just got lucky on that one!

That being said, our best AirBnB deal came last month when we booked a week in Montreal for only $15 a night!

How much money is coming in

Since I’m doing a mix of contract jobs, writing blog posts and mentoring, the money isn’t too steady. But here’s what we’re expecting to bring in over the next 30 days:

Guest blog posts

$1000

Short term contract job

$1020

Ongoing contract job

$2000

Online mentoring

$700

That’s $4,720 for the next 30 days. After tax it will round out to about $3,540. Not too bad!

This at least means we’re covered for the 30 days. But the reality is that this work isn’t stable. So we’re still trying as hard as we can to budget properly and be conscious of every penny we spend so that we can stretch this money as far as it can go.

At this moment we have $1000 in our bank account and $0 on our credit card. We’re currently in Berlin, Germany and have our AirBnB paid for up until the 29th. We’re not sure where we’ll go after this but we’ll definitely try to keep the theme of cheap housing!

So that’s what our finances look like at the current moment. If you have any questions or feel like we missed any details, don’t hesitate to contact us via email or on Twitter.

Thanks for reading!

If you want to follow along on our journey, you can subscribe to our YouTube Channel or subscribe to our blog. Thanks for reading, we'll see you on the road!